Maintain Ideal Thermal Conditions with PWM-Controlled Cooling Fans

Maintaining ideal thermal conditions is crucial for the efficient and reliable operation of electronic devices and systems. One of the most effective methods to achieve this is through the use of PWM-controlled cooling fans. Pulse Width Modulation PWM technology allows precise control over fan speed by adjusting the duty cycle of the electrical signal powering the fan. This dynamic control means the fan can ramp up or down in response to real-time temperature changes, ensuring optimal airflow without wasting energy. Unlike traditional fans that run at a constant speed, PWM fans provide tailored cooling that directly corresponds to the device’s heat generation, reducing wear and noise. PWM-controlled fans excel in balancing performance and energy efficiency. By modulating the fan speed, the system avoids running the fan at full capacity unnecessarily, which can lead to excess power consumption and increased noise levels. When the device’s temperature is low, the fan operates at a slower speed or even remains off, conserving energy and extending the fan’s lifespan.

As temperatures rise due to workload or environmental factors, the PWM signal adjusts to increase the fan speed, providing enhanced cooling to prevent overheating. This adaptive response not only maintains safe thermal limits but also improves the overall energy profile of the cooling system. Another advantage of PWM-controlled cooling fans is their ability to maintain system stability and prevent thermal throttling. Electronic components such as CPUs, GPUs, and pwm fan meaning power supplies can experience performance degradation or shutdown if temperatures exceed safe thresholds. PWM fans help avoid these scenarios by ramping up airflow before critical temperatures are reached, preserving device performance and longevity. This proactive thermal management ensures that devices can operate at peak capacity for extended periods, which is especially important in high-performance or mission-critical applications. The versatility of PWM fan technology also supports a wide range of applications, from compact consumer electronics to industrial equipment and server environments.

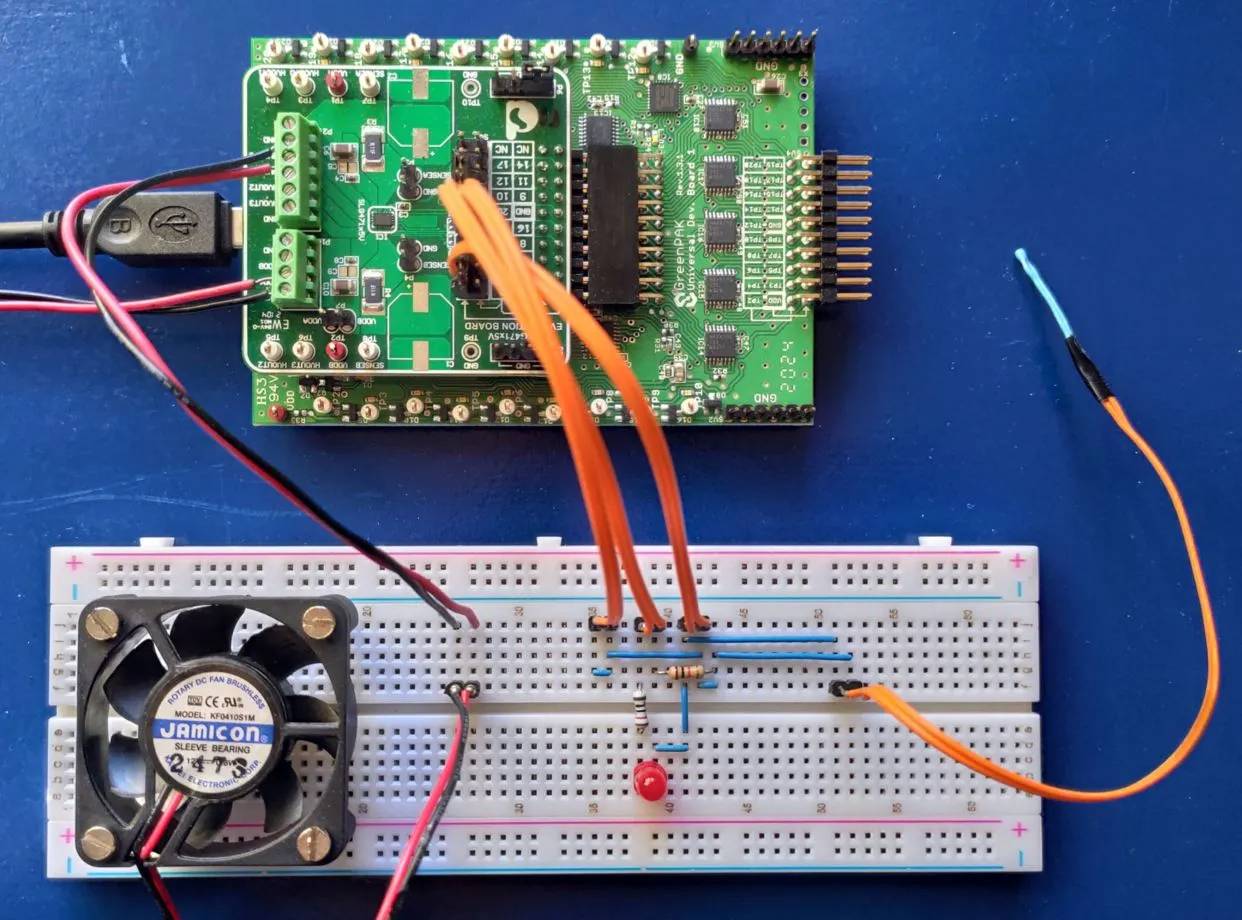

Because these fans can be precisely controlled, they are ideal for systems where space constraints and noise sensitivity are concerns. Their ability to modulate speed allows for quieter operation during periods of low thermal demand, making them suitable for office and home settings where ambient noise matters. At the same time, their rapid response to temperature increases makes them reliable for intensive computational tasks or environments with fluctuating thermal loads. Installation and integration of PWM-controlled fans are typically straightforward, as they can be managed through standard motherboard headers or dedicated fan controllers. This compatibility facilitates seamless incorporation into existing thermal management architectures. Additionally, many systems include software solutions that monitor temperature sensors and adjust acdcfan signals accordingly, providing users with customizable control over cooling performance. This integration of hardware and software enhances the precision and responsiveness of thermal regulation. PWM-controlled cooling fans represent a smart solution for maintaining ideal thermal conditions in various electronic devices.